Describe the Relationship Between Risk and Return

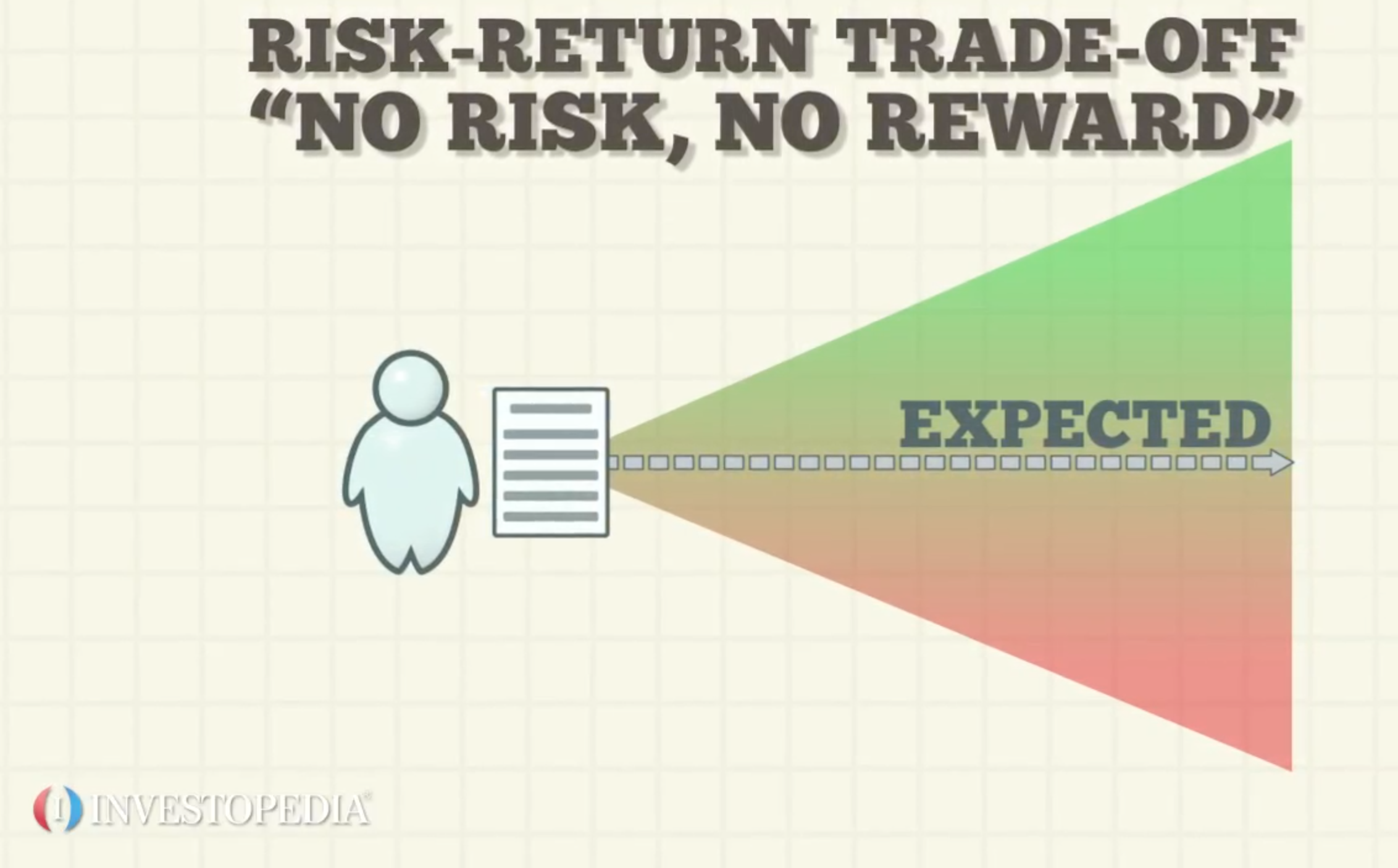

The relationship between risk and potential return is often depicted as a straight line. Risk is the chance of you losing your investment.

Risk Return Tradeoff Definition

What is the relationship between risk and return.

. Risk can be managed by Time Frame Diversification Your Risk Tolerance Level. The relationship between risk and required rate of return is known as the risk-return relationship. As a general rule investments with high risk tend to have high returns and vice versa.

When nominal risk-free rate increases the SML will shift up implying a higher rate of return while still having the same risk premium. The relationship between risk and return can be observed by examining the returns actually earned by investors in various types of securities over long periods of time. Using the risk-reward tradeoff principle low levels of uncertainty risk.

In general the more risk you take on the greater your possible return. Risk denotes deviation of the actual return from the estimated return. Think of lottery tickets for example.

Short-term savers concerned about how to protect their capital would look for a high-interest saving account in an authorized bank where there money would be safe money readily available when required. However as future is uncertain the future expected returns too are uncertain. Direct Relationship between Risk and Return A High Risk - High Return According to this type of relationship if.

There is no guarantee that you will actually get a higher return by accepting more risk. Why would anybody invest in a risky investment if there are safer investments to choose from. Risk refers to the variability of possible returns associated with a given investment.

Since risk and return are interrelated a term deposit or a bank account is low risk and government guaranteed. The fact that the investors do not hold a single security which they consider most profitable is enough to say that they are interested not only in maximization of return but also minimization of risk. The greater the risk the higher the potential for profit or loss.

The risk of an investment is the risk that the actual return we receive on that investment will be different to the return that we expected. Relationship between risk and return when investing. Dealing with the return to be achieved requires estimate of the return on investment over the time period.

High risk may give you high returns but the probability of that high returns depends upon the investment option. In other words it is impossible to make a lot of money in the stock market at low risk. The relationship between risk and return is direct.

There is an inherent risk to everything. 1-4 Relationship Between Risk and Return Changes in Market Condition or Inflation A change in the RRFR or the expected rate of inflation will cause a parallel shift in the SML. The relationship between risk and return when investing Definition of risk and return.

Therefore the higher the risk of an investment the higher its returns have to be to attract investors. When risk decreases the required rate of return decreases. The answer is that in order to attract investors riskier investments typically offer a higher potential for profit.

Risk aversion explains the positive risk-return relationship. So in the perfect world you would choose the desired risk and receive the expected return. Introduce your project with a reflection on the importance of selecting the right projects in which to invest capital.

Note that the focus. Actual Rate of Return Required Rate of Return. It is the uncertainty associated with the returns from an investment that introduces a risk into a project.

You may be wondering. So the obvious conclusion could be. There is a direct relationship between risk and return because investors will demand more compensation for sharing more investment risk.

First you have to keep in mind that in order to. Return refers to either gains or losses made from trading a security. In this article you will discover how risky investing is.

Relationship between Risk and Return 1. Finance professionals believe that investor expectations of the relative returns anticipated from various types of securities are heavily influenced by the returns that have been earned on these securities over. The expected return is the uncertain future return that a firm expects to get from its.

Increased potential returns on investment usually go hand-in-hand with increased risk. Another way to look at it is that for a given level of return it is human nature to prefer less risk to more risk. Risk along with the return is a major consideration in capital budgeting decisions.

Risk and return are always linked when investing. Generally the higher the potential return of an investment the higher the risk. Once your portfolio has been fully diversified you have to take on.

The Relationship between Risk and Return. Do we always select those projects that have the highest return on investment ROI. But how quickly does the risk increase and to what level do you dare to go.

The risk-return relationship. In investing risk and return are highly correlated. Identify an example of risk and return.

It is a positive relationship because the more risk assumed the higher the required rate of return most people will demand. Diversification enables you to reduce the risk of your portfolio without sacrificing potential returns. Different types of risks include project-specific risk industry-specific risk competitive risk international risk and market risk.

Describe the relationship between risk and return and how you would measure for both in your project. The firm must compare the expected return from a given investment with the risk associated with it. A person making an investment expects to get some returns from the investment in the future.

The return required increases as risk increases. Relationship between risk and return In penultimate conclusion we touch upon the relationship between risk and return. To earn more just increase the risk.

Actual return includes any gain or loss of asset value plus any income produced by the asset during a period. While there are different sub-sets of risk the common factor between most of those sub-sets is that they are all measured by calculating the standard deviation of the expected return on the investment. The higher the risk the greater the potential return.

However it is a bit more complex than that so lets examine how the relationship between risk and the required rate of affects the value of a company. The relationship between risk and return is often represented by a trade-off. Figure 6 shows this relationship and it is evident that the relationship is positive ie.

Relation between Risk and Return is probabilistic. A positive correlation exists between risk and return.

Pin By Hoang Phan On Finance Accounting Education Negative Relationships Financial Management

Risk Return Relationship In Investments Investing Financial Management Positive Cash Flow

No comments for "Describe the Relationship Between Risk and Return"

Post a Comment